ITS – INDIVIDUAL TAX SYSTEM

Customer from: Sinagpore.

Engagement model: fixed price.

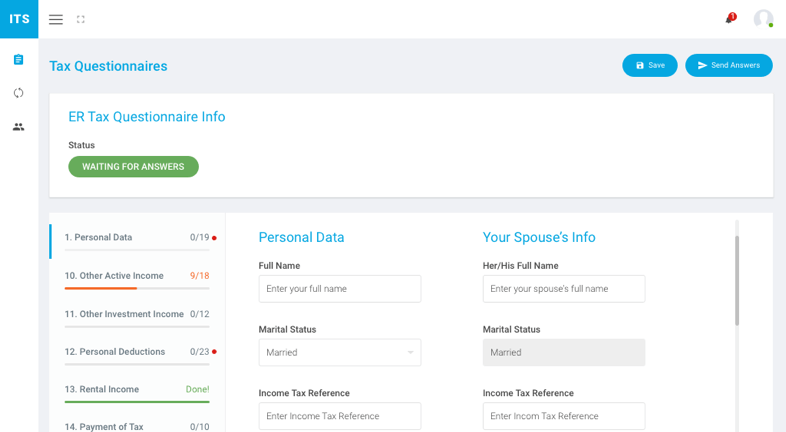

SCREENSHOTS

FEATURES

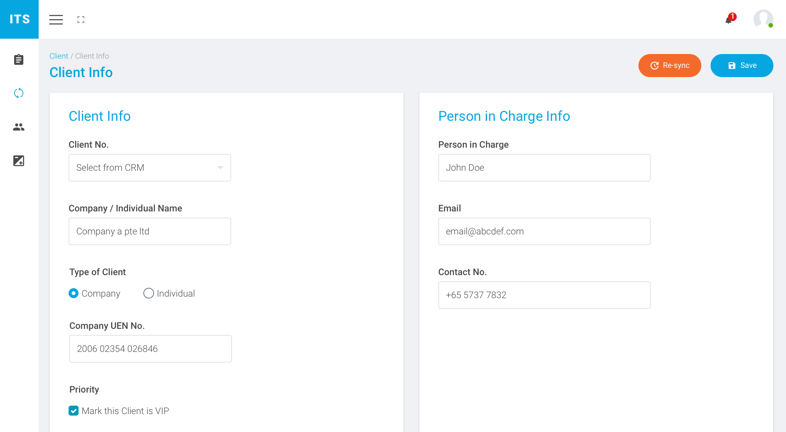

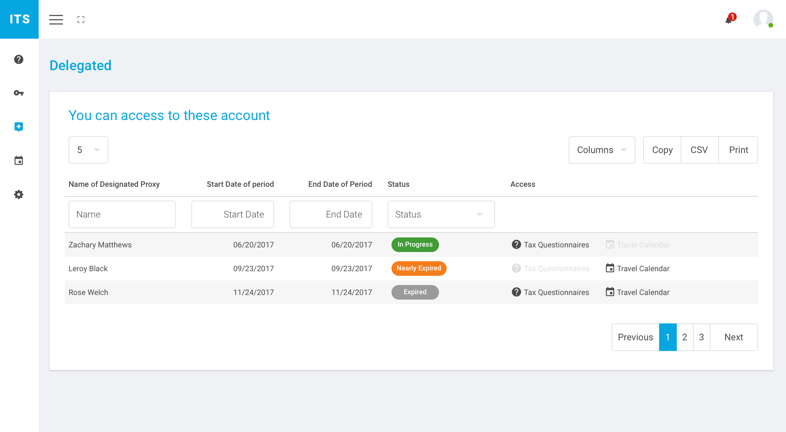

- CRM integration.

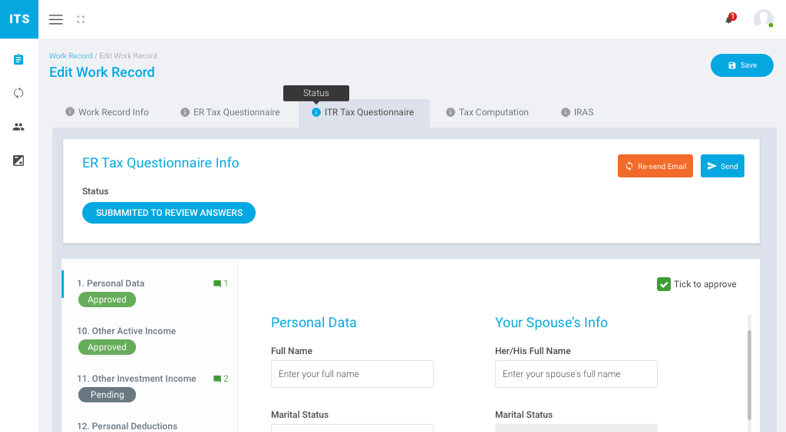

- Permission support to control fields visible, diable or not for difference user role.

- IRAS (Inland Revenue Authority Of Hong Kong) integration: submit XML file to IRAS: IR21; Form B1.

- Full Individual Tax Information – 16 Tax Questionnaire Sections for both Employee and Employer.

- Tax Computation: Multiple formular by configable and export result to PDF files.

TECHNOLOGIES

- .NET Core 2

- jQuery DataTable

- Entity Framework Core 2

- Auto Mapper

- Fluent Validation

- Hangfire (Background Job)

- Swagger: Gen and UI

CHALLENGES

- Many business inside.

- Tax Computation need 100% cover all cases and exactly amount.

- Multiple currency supported.

SOLUTIONS

- Follow exactly existing herd copy of Tax Questionnaires.

- Refer IRAS documents.

- Currency Rate use API from Monetary Authority of Hong Kong (MAS) (http://www.mas.gov.sg/)

- Do comparation testing to ensure tax computation result is correct.